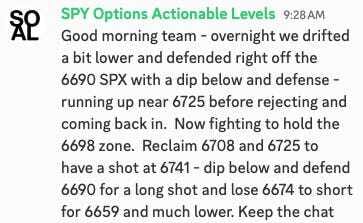

- SPY Options Actionable Levels

- Posts

- Wednesday November 26 2025 SPY SPX ES Actionable Levels

Wednesday November 26 2025 SPY SPX ES Actionable Levels

$SPX dips, defends, reclaims and runs RIGHT at our key support levels. Holiday run over for $SPY?

In yesterday’s letter, we wrote:

For tomorrow, we’re closely watching the key SPX levels of 6674, 6690, 6725, and 6758. In the aftermath of today’s rally, our bias remains bullish as long as lower supports hold, and we’ll look to enter longs on a dip & defense at 6690 or via a direct defense at 6674, with a hold of 6708 overnight also signalling strength. A successful push through 6725 and then 6741 would pave the way to 6758, and a breach of 6758 would open a run to 6779”

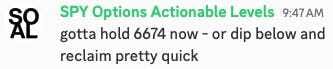

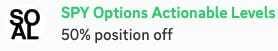

This is what happened. Overnight we had a beautiful dip and defense at 6690 SPX, then pushed up toward 6725 before settling into consolidation. Then, in the regular session, price gave us a quick shakeout, dipping to 6674 and tagging our 6659 support almost to the penny (low of day: 6659.98). From there, buyers stepped in, and we reclaimed 6675 and 6690, then powered straight through every upside resistance level on the sheet, ultimately reaching near our 6779 target(high of day: 6776.4). Picture perfect levels. $SPY ( ▲ 0.72% ) $SPX ( ▲ 0.69% ) $ES_F ( 0.0% )

See how well the levels work?

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

Now, as we reflect on the day’s trading, what levels should we focus on to maintain our bullish stance? Where is the next resistance, and how can we continue to navigate this upward trend effectively? Are we now setup to rest for turkey day?

More in the trade plan below.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

The 6659 defense (to the penny practically) and the reclaim of 6690 to run nearly to 6779 target are textbook examples of the levels at work. Always trust the levels.

Now we are sitting in AH right on the key 6764 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Trading Plan

Today’s performance delivered a solid 1% gain, albeit on lower holiday volume, which is typical as we approach the Thanksgiving break.

Looking ahead, tomorrow brings critical unemployment data before the market opens, followed by durable goods orders and Chicago PMI data. Given the holiday season, we can expect continued lower volume, making it crucial to stay alert and ready to adjust our strategies based on incoming data.

We are receiving some great questions from beginners. This is helping us develop guides for this group as well as the course. More to come but we’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, we’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, we’re closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.