- SPY Options Actionable Levels

- Posts

- Wednesday March 5 2025 SPY SPX ES Actionable Levels

Wednesday March 5 2025 SPY SPX ES Actionable Levels

$SPX loses key level and drops 2% before rallying back to flat and then sells off again. With Trump speech tonight, where does $SPY go next?

In yesterday's letter, we wrote:

For tomorrow, we’re closely watching the key SPX levels of 5863, 5847, and 5842.

For longs, the charts look quite catastrophic until we can reclaim much higher levels, effectively wiping out today’s losses. Until then, look to hold 5842—no lower. We could long a dip and defense at 5847, or even better if we don’t lose 5863.

From there, we can target a move up through 5868…

If we lose 5842, then it’s short to 5828, 5810, 5793, and 5772.”

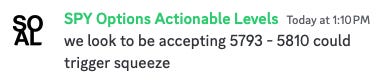

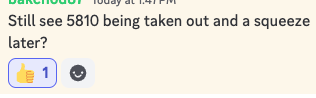

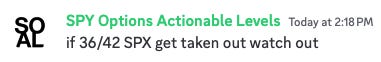

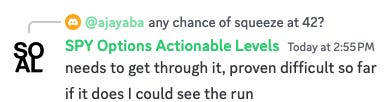

This is what happened. The market opened lower and lost the crucial 5842 level in pre-market trading. After that, it was a downward spiral, reaching a low of 5732.59. However, we saw a brief recovery as we reclaimed 5793, which gave us a shot at forming a bottom. After successfully reclaiming 5810 and 5828, we launched back up to a high of 5865, even managing to close positive for a short time before dipping back down to settle slightly above 5772.

See how well the levels work?

Tackle your credit card debt by paying 0% interest until nearly 2027

Reduce interest: 0% intro APR helps lower debt costs.

Stay debt-free: Designed for managing debt, not adding.

Top picks: Expert-selected cards for debt reduction.

Now that we’ve experienced such volatility, what does this mean for us moving forward? What is next for the trade war and what clues & reaction will the speech tonight give?

More in the trade plan below.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

Levels played out remarkably well as we lost the critical 5842 support and fell through all downside targets. However, the bounce back was notable, and even though we ended down 1.2%, we managed to witness some resilience as we reclaimed key levels throughout the day. Always trust the levels.

Now we are sitting in AH right on the key 5804 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

Trading Plan

Today was a massive 2% red day at its worst, and we turned things around to flat before dipping again, all on extremely high volume—the highest since August 2024.

Tonight, we have the President's address to Congress, and tomorrow we can expect employment data and PMI prior to the open. Keep an eye on these economic indicators as they may significantly impact market sentiment and direction.

I am receiving some great questions from beginners. This is helping me develop guides for this group as well as the course. More to come but I’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, I’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, we’re closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.