- SPY Options Actionable Levels

- Posts

- Tuesday November 25 2025 SPY SPX ES Actionable Levels

Tuesday November 25 2025 SPY SPX ES Actionable Levels

$SPX reclaims key resistance and takes off. How much further can $SPY retrace prior levels?

In Friday’s letter, we wrote:

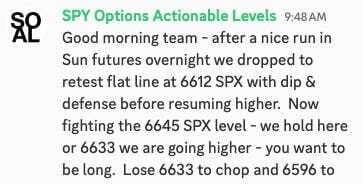

For Monday, we’re closely watching the key SPX levels of 6596, 6612, and 6633. Having held 6596 into the close, our bias is now cautiously bullish, with added conviction if we can also hold 6612. We’ll look to pick up longs on a direct defense at 6596 or a dip & defense at 6612, and a clean break above 6633 can be taken as a fresh long signal. From there, upside targets come into play at 6645, 6661, 6678, 6693, and 6710.”

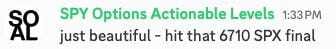

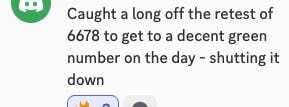

This is what happened. The market opened with strong momentum after successfully defending the critical 6612 level during Sunday futures, which laid the groundwork for a bullish session. As anticipated, we broke through the 6645 resistance and continued to surge, peaking at a high of 6715.75, right at our 6710 upside target. $SPY ( ▲ 0.72% ) $SPX ( ▲ 0.69% ) $ES_F ( 0.0% )

See how well the levels work?

Crash Expert: “This Looks Like 1929” → 70,000 Hedging Here

Mark Spitznagel, who made $1B in a single day during the 2015 flash crash, warns markets are mimicking 1929. Yeah, just another oracle spouting gloom and doom, right?

Vanguard and Goldman Sachs forecast just 5% and 3% annual S&P returns respectively for the next decade (2024-2034).

Bonds? Not much better.

Enough warning signals—what’s something investors can actually do to diversify this week?

Almost no one knows this, but postwar and contemporary art appreciated 11.2% annually with near-zero correlation to equities from 1995–2024, according to Masterworks Data.

And sure… billionaires like Bezos and Gates can make headlines at auction, but what about the rest of us?

Masterworks makes it possible to invest in legendary artworks by Banksy, Basquiat, Picasso, and more – without spending millions.

23 exits. Net annualized returns like 17.6%, 17.8%, and 21.5%. $1.2 billion invested.

Shares in new offerings can sell quickly but…

*Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Now, with such a significant move higher, the question is whether we can sustain this momentum. What levels must we hold to avoid a pullback, and where should we look for fresh long entries?

More in the trade plan below.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

The defense of 6612 was crucial, providing a solid foundation for the rally. Ultimately we ran all the way to 6715 and settled at 6705 - right at our final resistance target of 6710. Always trust the levels.

Now we are sitting in AH right on the key 6708 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

Own a Home? Unlock Lower Auto Insurance Rates

Owning a home gets you equity, a place that’s all yours, and now, better auto insurance rates. Drivers who own their home, own multiple cars, and have a clean driving record can save big by comparing insurance rates. And now, with EverQuote, that process is easier than ever.

EverQuote is a smart insurance marketplace built for people like you. We simplify the entire process:

Quick & Easy: Stop filling out the same forms repeatedly.

Maximum Savings: We connect you with trusted national and local carriers.

Confidence in Coverage: Our platform helps you compare and confidently select the perfect policy.

You deserve great coverage without the headache.

Trading Plan

Today’s impressive 1.5% move was achieved on lower holiday week volume, suggesting that while the upward momentum is strong, it may be prudent to watch for potential volatility ahead.

Looking ahead to tomorrow, we have a busy day lined up with PPI, retail sales data, and pending home sales data to be released. These economic indicators could significantly influence market direction, so it’s vital to remain alert and ready to adapt our strategies as the data unfolds.

We are receiving some great questions from beginners. This is helping us develop guides for this group as well as the course. More to come but we’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, we’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, we’re closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.