- SPY Options Actionable Levels

- Posts

- Tuesday November 11 2025 SPY SPX ES Actionable Levels

Tuesday November 11 2025 SPY SPX ES Actionable Levels

$SPX breaks key resistance to run 1.5% higher-rejecting right at final resistance level. Is $SPY ready to resume ATH streak?

In Friday’s letter, we wrote:

For Monday, we’re closely watching the key SPX levels of 6670, 6710, 6735, and 6758. After today’s monster dip & defense to close green, the short may have played out and our bias shifts higher as long as critical supports hold. We’ll look to buy dips & defend at 6710 or 6721, or lean long if Sunday futures can hold 6735, which would set up a push through 6746. Reclaiming 6758 would confirm a move higher and open targets at 6774, 6808, and potentially 6837.”

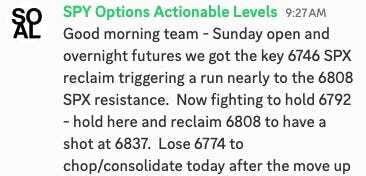

This is what happened. The levels played out perfectly today as anticipated. Sunday futures opened bullishly, buoyed by positive government news. The ability to reclaim 6746 led to a significant rally, propelling the SPX all the way up to 6808. In the regular session, we dipped but successfully defended the key 6774 level, which set the stage for a final push to the high of day at 6841.32, RIGHT at our final resistance target of 6837. $SPY ( ▼ 1.08% ) $SPX ( ▼ 1.05% ) $ES_F ( 0.0% )

See how well the levels work?

Debt sucks. Getting out doesn’t have to.

Americans’ credit card debt has surpassed $1.2 trillion, and high interest rates are making it harder to catch up (yes, even if you’re making your payments). If you’re in the same boat as millions of Americans, debt relief companies could help by negotiating directly with creditors to reduce what you owe by up to 60%. Check out Money’s list of the best debt relief programs, answer a few short questions, and get your free rate today.

Now, as we ride the momentum from today’s bullish performance, the question is whether we can sustain this upward trajectory. What levels must hold to ensure the rally continues, and where do we find new support to maintain this bullish bias?

More in the trade plan below.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

The overnight knockout of 6746 and intraday dip & defense at 6774 were key long triggers that ran us all the way to final SPX resistance at 6837. Always trust the levels.

Now we are sitting in AH right on the key 6833 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Shares at $0.81 until Nov 20 — then the price moves. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Trading Plan

Today marked a massive 1.5% gain on decent volume, albeit lower than Friday’s trading activity. This suggests that while enthusiasm is present, we should remain cautious of potential pullbacks.

Looking ahead, tomorrow is projected to be quieter due to banks being closed for Veteran’s Day. However, it’s essential to keep an eye on any developments in Washington that could impact the market, particularly regarding government shutdown news. Staying informed will be key as we navigate the coming sessions.

We are receiving some great questions from beginners. This is helping us develop guides for this group as well as the course. More to come but we’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, we’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, we’re closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.