- SPY Options Actionable Levels

- Posts

- Tuesday Jan 9 2024 SPY SPX ES Actionable Levels

Tuesday Jan 9 2024 SPY SPX ES Actionable Levels

$SPX squeezes hard. Is the bottom in for $SPY and what key levels keeps us on track for new all time highs?

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

7 hours left - Pre-Order at $66 - 20% off Regular Price

Before the update for game plan + levels, I wanted to talk about something I’m very excited about. It’s on the below topic:

It can challenging to profit on options or maintain consistency.

Even when the underlying stock moves your way you can lose money if you don’t understand the driving forces behind contract prices. This can take you out of the game fast.

I’ve realized that many students are newer to this world and can benefit from understanding the fundamental & emotional lessons that can make consistency achievable.

I’ve even thrown in some bonus items including a free month of the premium levels.

Take a look at the details & save your seat now to lock in 20% off regular pricing below. Only $66 and 7 hours left before it’s closed. Let me know your thoughts!

In Friday’s letter, I wrote:

“For Monday, we need to hold the critical SPX level of 4683 in order to keep this reversal hope alive.

If we do so, or fail and quickly reclaim (even better if we don’t retest) we can target 4724, 4734 and 4757 on volume.”

This is exactly what happened. We defended the critical level of 4683 in overnight Futures (even had a failed breakdown of this level) then blasted off breaking through all of those levels even the 3rd target into the close hitting an intraday high of 4764.54.

See how well the levels work?

Now that we’ve defended the breakdown below the range we have been building for 1+ months, where do we go from here? What must-hold levels are key to keep a path to all time highs?

More in the trade plan below.

The 0DTE $SPX 4730 calls ran from a low of $90 to $3520 = 3811% gain.

I traded these from $215 to $510 for 137% at best sale. I wish I had held on longer knowing what I know now, but you are never going to get all of it. Not awful for a day I planned to close out of some longer dated longs and not trade roundtrip. More in the trade recap below.

Below, we’ll cover the actionable levels, how I played them today and what they mean for the next session.

Levels from the prior letter were great. Once we put in the reclaim of key levels it was off to the races and we floated on up. Always trust the levels!

Now we are sitting in AH right under the 4759 key resistance level. What does this all mean and where do we go from here? Read below for my trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Trading Plan

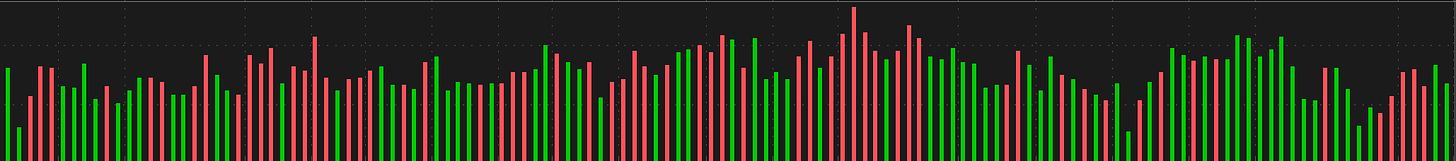

Here is a current check of the daily:

This includes all the way back to 6/29 & all overnight action.

We in fact put in the doji on Friday leading to today’s monster rally and reclaim of key levels within the range of the last month.

I asked on Friday, “Is this the candle that reverses us and pops us back into the range above?” and in fact, yes, yes it was.

Quick volume check:

Lower volume on Monday reversal rally day has me a bit concerned, would have liked to at least see similar volume to Friday - but it’s in the margin.

Tomorrow we are fairly light on some lesser data releases in the AM with fed member speech in afternoon.

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, it will be extremely bullish if we don’t even retest the key SPX level of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.