- SPY Options Actionable Levels

- Posts

- Tuesday February 3 2026 SPY SPX ES Actionable Levels

Tuesday February 3 2026 SPY SPX ES Actionable Levels

$SPX loses must-hold support level overnight to fall to final downside support target before reclaiming in regular session and running 150+ points from the low. Is $SPY about to print ATH?

In Friday’s letter, we wrote:

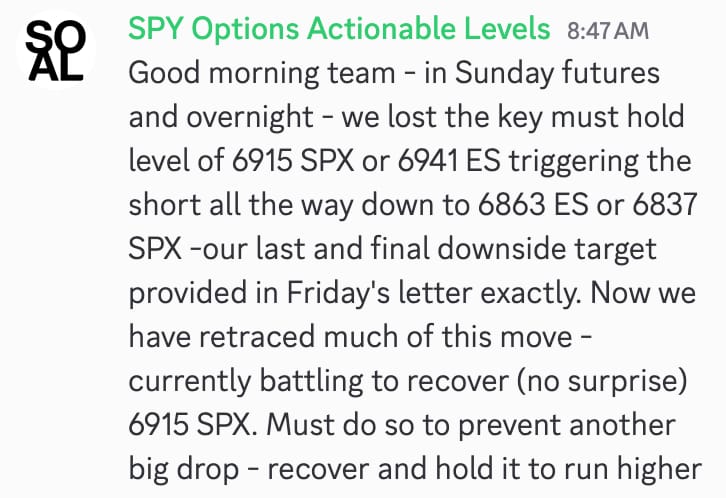

For Monday, we’re closely watching the key SPX levels of 6885, 6915, 6929, 6939, and 6970. We twice tested and recovered from our must-hold support today, so our bias hinges on maintaining key supports immediately below us—if we hold, we buy dips; if we lose them, we short…a break below 6915 would flip the bias to the downside, targeting 6900 and 6885, and a further breach of 6885 would open the path to 6870, 6851, and 6837.

On the long side, we want to see a firm defense at 6915 or, ideally, a dip & defense at 6929, with a push through 6939triggering longs toward 6970 and 6984.”

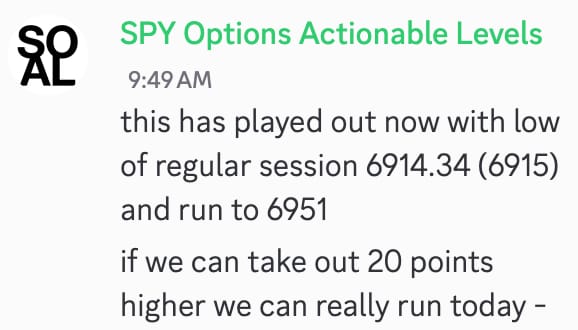

This is what happened. The levels we monitored played out perfectly today. In Sunday futures we had a significant dip, losing the key 6915 SPX level overnight. This triggered the sell, leading to a swift drop down to our target of 6837 SPX, precisely hitting our downside mark (6864.5 ES). As we approached the regular session, the market showed resilience. We defended the 6915 level with strength, and from there, we initiated a powerful rally that pushed us up through the key resistance target of 6970, reaching a high of 6991, just above our 6984 target. $SPY ( ▲ 0.72% ) $SPX ( ▲ 0.69% ) $ES_F ( 0.0% )

See how well the levels work?

Why is everyone launching a newsletter?

Because it’s how creators turn attention into an owned audience, and an audience into a real, compounding business.

The smartest creators aren’t chasing followers. They’re building lists. And they’re building them on beehiiv, where growth, monetization, and ownership are built in from day one.

If you’re serious about turning what you know into something you own, there’s no better place to start. Find out why the fastest-growing newsletters choose beehiiv.

And for a limited time, take advantage of 30% off your first 3 months with code LIST30.

Now, as we look ahead, we need to focus on sustaining these gains. Will we hold the established support, or will we see another pullback? What levels above must we monitor for further upside potential?

More in the trade plan below.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

Today’s drop to exactly our final downside support target after losing 6915 overnight and then the reclaim in the AM of 6915 causing the major run through upside targets are prime examples of our levels at work. Always trust the levels.

Now we are sitting in AH right on the key 6981 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

Trading Plan

Today’s trading session resulted in an impressive range of over 150 points, reflecting significant volatility but also highlighting the potential for lucrative trades when the levels are respected.

For tomorrow, we have at least two FOMC members speaking in the morning, along with JOLTS jobs data, which could add another layer of impact on market dynamics. Stay sharp and ready to react to the data releases.

We are receiving some great questions from beginners. This is helping us develop guides for this group as well as the course. More to come but we’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, we’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, we’re closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.