- SPY Options Actionable Levels

- Posts

- Tuesday Dec 26 2023 Part 2 SPY SPX ES Actionable Levels

Tuesday Dec 26 2023 Part 2 SPY SPX ES Actionable Levels

$SPX chops most of day but closes green. More consolidation for $SPY?

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

In the last two months I switched from Mint (it’s apparently going away anyway) and moved to YNAB. It was the best decision ever. I have never felt so in control of money and how we are spending it in different categories and saving/investing in different projects/goals. Never have I had a picture of our current spending in this way (and now know the age of our money!).

Instead of being reactive like Mint and others (just telling you where you spent your money) instead you are proactive and assign each dollar a job as soon as you get it! It’s actually fun and you and your significant other end up having more $$ for fun stuff and less stress.

Anyway thought I would share, give it a shot. You can get a free trial PLUS if you use the link below you get an additional month free after subscribing. There are mobile apps and it all just works amazingly well. Cannot recommend enough. Click here for more info.

There are amazing free live sessions with YNAB to get up and running - also plenty of great videos on YouTube to set it up how it will work best for you. It is extremely flexible and customizable.

This is an updated letter for Tuesday parts originally posted Friday.

In yesterday’s letter, I wrote:

“For tomorrow, if we decide to dip at all we must hold the key SPX level of 4733.

If we do so, we can make a push to 4756.

We also could chop between 4717-4756 or so and not really make a meaningful move.”

This is where we went. We rallied overnight and into the open and hit north of the 4769 SPX level. Then, we tested 4756 from above a couple hours into the open. Finally reclaiming 63 and then losing 56 with a stab down to 4736 just above the 4733 must hold level. Then we rallied back near 4756 into the close.

See how well the levels work?

Now that we consolidated, put in a defense and closed green where do we go post Christmas Day? How much more consolidation and what are the now must hold levels and next targets above?

More in the trade plan below.

The 4DTE $SPY 475 calls ran from a low of $110 to $189 = 72% gain.

I traded these from $134 to $180 for 34% gain. This was my only trade of the day called out in the chat. Typically I wait for at least 15 minutes after the open to trade, today I did not. A quick one and done and then I watched. It was hard to watch for some of it as I did want to re-enter. But years of doing this have taught me that is rarely worth it. More in the trade recap below.

Below, we’ll cover the actionable levels, how I played them today and what they mean for the next session.

Levels from the prior letter were great. They showed clear support and rally overnight, then tests of those levels in the regular session from which we based previously. Always trust the levels!

Now we are sitting in AH right on the 4745 key support level. What does this all mean and where do we go from here? Read below for my trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

Trading Plan

Here is a current check of the daily:

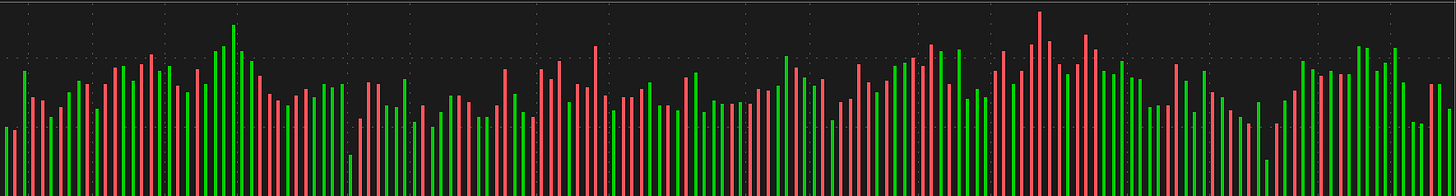

This includes all the way back to 3/30 & all overnight action.

We printed a doji but defended midpoint of this range and closed the day green.

Quick volume check:

Today’s volume is not surprising to be less than prior two. It’s the Friday before Christmas week for crying out loud!

Tuesday is super light in terms of events/data. Just two reports prior to the open.

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For Tuesday, it would be extremely bullish if we do not…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.