- SPY Options Actionable Levels

- Posts

- Tuesday April 8 2025 SPY SPX ES Actionable Levels

Tuesday April 8 2025 SPY SPX ES Actionable Levels

$SPX prints massive 400+ doji. Has $SPY found short-term bottom?

In Friday’s letter, we wrote:

For Monday, we're closely watching the key SPX levels of 5045, 5031, 5086, and 5116.

If we can get an opportunity to long a dip & defense of 5045 or 5031, we would take it. Then we can make an attempt at reclaiming 5086, which is key for higher. Reclaim there, and we target 5103 and 5116. If we take this out, then we can squeeze higher to 5130, 5146, and 5160.

If we lose 5031, we want to be short for the move to 5015, 4998, 4984, 4972, and 4960.”

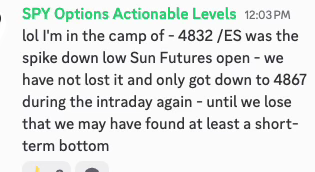

This is what happened. The day started with a bang but quickly turned into a rollercoaster ride. We lost the crucial 5031 level in futures trading on Sunday, which triggered a hard spike down. Then in regular session opening, we dropped to low of the day at 4835.04. However, the market did not stay down for long. We rallied back aggressively, reaching a high of 5246.57 before facing resistance and losing the 5031 level multiple times throughout the day as hard resistance.

By the afternoon, we managed to break through the resistance and 5031 became support. This was a pivotal moment, allowing us to close the day at 5062. The levels played out beautifully, as we had both scenarios unfold, showcasing the volatility of the market. $SPY ( ▲ 0.72% ) $SPX ( ▲ 0.69% ) $ES_F ( 0.0% )

See how well the levels work?

The Supply Chain Crisis Is Escalating — But This Tech Startup Keeps Winning

Global supply chain chaos is intensifying. Major retailers warn of holiday shortages, and tech giants are slashing forecasts as parts dry up.

But while others scramble, one smart home innovator is thriving.

Their strategic move to manufacturing outside China has kept production running smoothly — driving 200% year-over-year growth, even as the industry stalls.

This foresight is no accident. The same leadership team that saw the supply chain storm coming has already expanded into over 120 BestBuy locations, with talks underway to add Walmart and Home Depot.

At just $1.90 per share, this resilient tech startup offers rare stability in uncertain times. As investors flee vulnerable companies, this window is closing fast.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

Now, where do we go from here? With the incredible 411-point range and a doji candle signaling indecision, buyers and sellers are likely to clash again. The market is currently in a state of flux, and with FOMC members speaking tomorrow, traders should be prepared for potential volatility. Did we find a short-term bottom? What levels above and below will confirm?

More in the trade plan below.

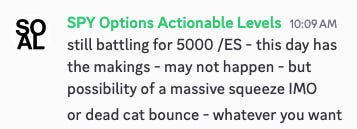

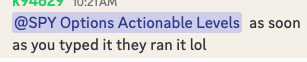

Literally 1 min prior (check a chart) to rumors of a 90 day tariff reprieve that sent the market up 295 point rally we wrote the below:

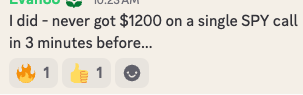

Then later in the session we pointed out a pivot spot to long that led to a 100+ move in minutes.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

The levels proved their value once again with a specific key level that provided upper end resistance for most of the day until it flipped and acted as support. Always trust the levels.

Now we are sitting in AH right on the key 5112 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

Trading Plan

Today was a massive day with a range of 400+ points and significant volume, even greater than Friday's action which was highest in years.

Tomorrow, we have at least one FOMC member speaking during the regular session. All eyes will be on any developments regarding tariffs and global negotiations, as even rumors can significantly impact market sentiment. Traders should remain vigilant and adaptable as we navigate through these volatile times.

I am receiving some great questions from beginners. This is helping me develop guides for this group as well as the course. More to come but I’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, I’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, we’re closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.