- SPY Options Actionable Levels

- Posts

- Thursday July 24 2025 SPY SPX ES Actionable Levels

Thursday July 24 2025 SPY SPX ES Actionable Levels

$SPX dipped, defended right on key support and broke out to fresh all time highs. What is next target for $SPY?

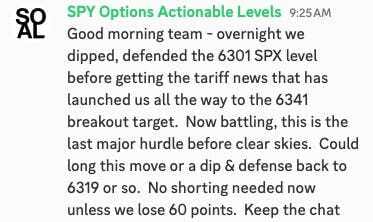

In yesterday’s letter, we wrote:

For tomorrow, we're closely watching the key SPX levels of 6341, 6301, 6290 and 6279. As long as we hold in the current range, we want to continue looking for long entries. This could come on a dip & defense of 6301 or 6290, or a direct defense of 6279 that bounces hard. Then we can push up through 6319, and if we break out above 6341, we definitely want to be long. This would open the door to upside targets at 6363.”

This is what happened. We witnessed the dip and defense at 6301 before the open that led us to a run up to 6341. This was followed by a retest and a breakout that carried us all the way up near our target of 6363, hitting a high of 6360.64. $SPY ( ▲ 0.72% ) $SPX ( ▲ 0.69% ) $ES_F ( 0.0% )

See how well the levels work?

Wall Street has Bloomberg. You have Stocks & Income.

Why spend $25K on a Bloomberg Terminal when 5 minutes reading Stocks & Income gives you institutional-quality insights?

We deliver breaking market news, key data, AI-driven stock picks, and actionable trends—for free.

Subscribe for free and take the first step towards growing your passive income streams and your net worth today.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Now that we got the breakout and fresh all time highs - where do we go from here? Where is must hold (now) below us and what is next major target above?

More in the trade plan below.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

The dip & defense at 6301 and the 6341 breakout were major signs that the market wanted higher. Always trust the levels.

Now we are sitting in AH right on the key 6362 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

Former Zillow exec targets $1.3T market

The wealthiest companies tend to target the biggest markets. For example, NVIDIA skyrocketed nearly 200% higher in the last year with the $214B AI market’s tailwind.

That’s why investors are so excited about Pacaso.

Created by a former Zillow exec, Pacaso brings co-ownership to a $1.3 trillion real estate market. And by handing keys to 2,000+ happy homeowners, they’ve made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO.

No wonder the same VCs behind Uber, Venmo, and eBay also invested in Pacaso. And for just $2.90/share, you can join them as an early-stage Pacaso investor today.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Trading Plan

For today, we enjoyed a solid move higher of about 3/4% on great volume. Looking ahead to tomorrow’s trading, we have a busier day lined up with unemployment PMI and new home sales data set to be released. Additionally, keep an eye on broader economic narratives, including trade deals and any news surrounding high-profile figures like Trump and Epstein, which could influence market sentiment.

Overall, the market remains in a bullish phase, and as long as we maintain our key levels, there are opportunities for continued upside.

I am receiving some great questions from beginners. This is helping us develop guides for this group as well as the course. More to come but we’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, we’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, we’re closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.