- SPY Options Actionable Levels

- Posts

- Thursday Jan 4 2024 SPY SPX ES Actionable Levels

Thursday Jan 4 2024 SPY SPX ES Actionable Levels

$SPX continues selling off. When does the pain end for $SPY?

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Few Spots Remain - Pre-Order at $66 - 20% off Regular Price

Before the update for game plan + levels, I wanted to talk about something I’m very excited about. It’s on the below topic:

It can challenging to profit on options or maintain consistency.

Even when the underlying stock moves your way you can lose money if you don’t understand the driving forces behind contract prices. This can take you out of the game fast.

I’ve realized that many students are newer to this world and can benefit from understanding the fundamental & emotional lessons that can make consistency achievable.

That’s why I’ve decided to use the holidays as a time to reset, focus on the basics and build something that I think will be beneficial for many of you.

It is a mini-course dedicated to solving the above challenge.

With this course, you’ll learn how to overcome pricing pitfalls, how options move & how to select a contract to capitalize on your desired strategy.

This would be designed as the perfect solution for a beginner looking to take their options knowledge to the next level. You’ll learn the fundamentals of options, how they’re priced & what makes them valuable in order to win.

I’m sending this out as a test balloon to gauge interest. If the interest is there I will put the final bow on this and get it out to all of you. I will even throw in some bonus items including a free month of the premium levels.

Take a look at the details & save your seat now to lock in 20% off regular pricing below. Only $66 and a few days left before it’s closed. Let me know your thoughts!

In yesterday’s letter, I wrote:

“For tomorrow, we absolutely must hold the key SPX level of 4719 in order to continue higher.

If we lose 4719, the short to 4706 as target 1 is in play.”

This is what happened. We fought with this level multiple times but ultimately lost it at the open of the regular session. That led to a low of 4704.72, just below the 4706 level above. The rest of the day saw multiple defenses precisely on 4706 and attempts at reclaiming/holding 4719 but ultimately could not. Into the close we dipped further, reaching the level below 4700 (low of 4699.71) before bouncing.

See how well the levels work?

Now that we have two strong red days to kick the year off, where do we go from here? What are next critical supports below that must hold to prevent an even deeper sell?

More in the trade plan below.

The 0DTE $SPX 4730 calls ran from a low of $65 to $560 = 762% gain.

I traded a very small part of this from $260 to $285 for 10%. Then I got stopped out on the rest. Today was horrible for me personally. This does not happen often, but it happens to everyone. I got chopped up. And yet, my plan as written was clear and should have worked, I just didn’t execute appropriately. More in the trade recap below.

Below, we’ll cover the actionable levels, how I played them today and what they mean for the next session.

Levels from the prior letter were fine. They showed where we had support amongst the selling and where we found resistance on short-lived pops higher. Always trust the levels!

Now we are sitting in AH right on the 4703 key support level. What does this all mean and where do we go from here? Read below for my trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

Trading Plan

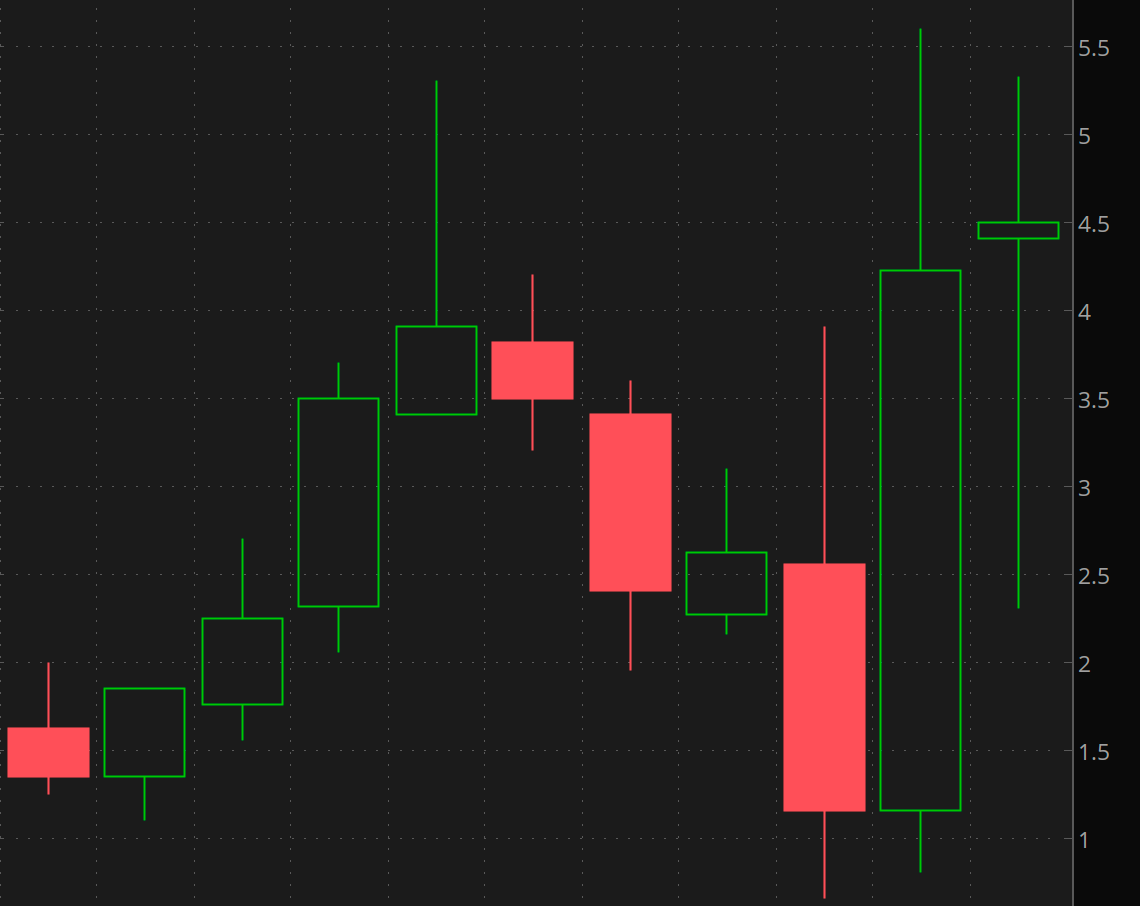

Here is a current check of the daily:

This includes all the way back to 6/29 & all overnight action.

Even deeper but so far have defended the low from 8 sessions ago. We are still within the current range and it may be a great longer dated spot to long.

Quick volume check:

About the same as yesterday - a bit higher. So far this doesn’t look like a major breakdown as we would have much higher volume if we sell below this range.

Tomorrow we have AM data, including jobs related numbers.

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, we must hold SPX level of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.