- SPY Options Actionable Levels

- Posts

- Thursday August 15 2024 SPY SPX ES Actionable Levels

Thursday August 15 2024 SPY SPX ES Actionable Levels

$SPX continues the move higher post CPI. When will volume return and where does $SPY head next?

These daily stock trade alerts shouldn’t be free!

The stock market can be a rewarding opportunity to grow your wealth, but who has the time??

Full time jobs, kids, other commitments…with a packed schedule, nearly 150,000 people turn to Bullseye Trades to get free trade alerts sent directly to their phone.

World renowned trader, Jeff Bishop, dials in on his top trades, detailing his thoughts and game plan.

Instantly sent directly to your phone and email. Your access is just a click away!

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - Mastering Emotions lesson launched and new lessons soon.

In yesterday’s letter, I wrote:

“For tomorrow, I am closely watching the key SPX levels of 5395, 5312 & 5438.

Tomorrow is CPI, and you should not trade if you do not have a plan, and are not going to follow firm rules and not position size appropriately.

I would say that if we dip and defend at 5395 or 5369 those are opportunities to get long.

In these cases we can rally up through 5438 and target 5459.”

This is what happened. The market opened with significant strength, never even needing to get down to 5395. Instead, we defended above the 5409 level to rally straight up to a high of 5463.22, which was just above the 5459 target level mentioned previously. The levels played out beautifully, confirming the importance of sticking to the strategy outlined in the previous letter.

See how well the levels work?

Now that we’ve seen a push above the expected targets, where do we go from here? What levels should we watch closely to maintain the bullish momentum or prepare for a potential pullback?

More in the trade plan below.

The $SPY 1DTE 545 calls from a low of $80 to $218, 173% gain.

I missed the large moves in the morning but did manage to scalp these calls twice. While I didn’t get the massive move I was hoping for, both trades were profitable. More in the trade recap below.

Below, we’ll cover the actionable levels, how I played them today and what they mean for the next session.

The levels played out great, not even needing to get down to 5395 and defending above the 5409 level to then rally straight up 5463.22, just above the 5459 target level. Always trust the levels!

Now we are sitting in AH right above the key 5453 support level. What does this mean and where do we go from here? Read below for my trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Trading Plan

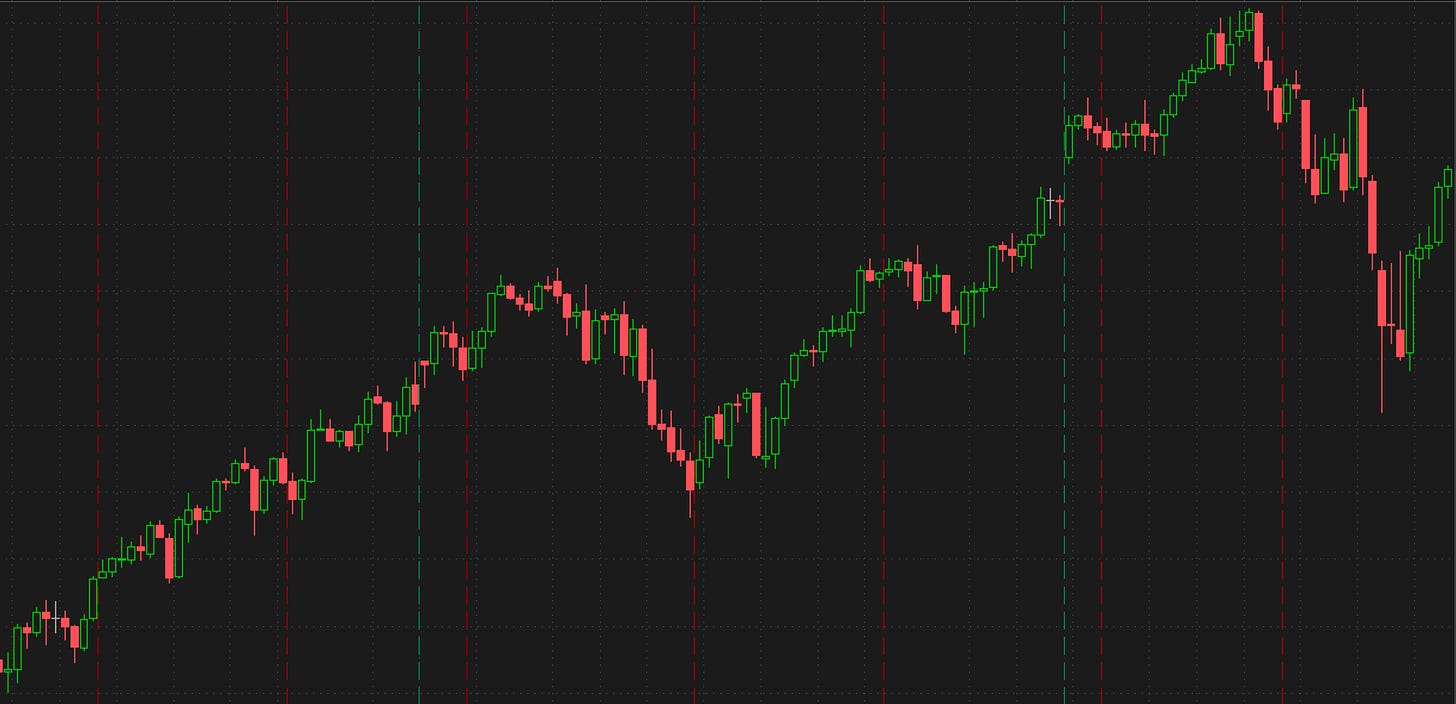

Here is a current check of the daily:

This includes all the way back to 1/5 & all overnight action.

The market’s performance today pushed us well into the range from late July, bouncing off the lows effectively.

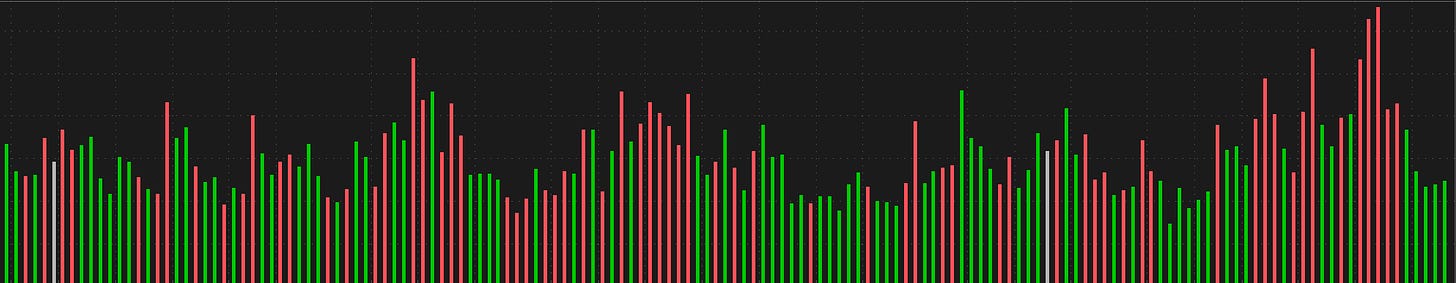

Quick volume check:

It’s worth noting that the volume was very light for a CPI day, which could suggest a lack of conviction among traders.

Looking ahead, tomorrow brings retail sales and unemployment data prior to the open, along with multiple FOMC members scheduled to speak during the trading session. Traders should remain vigilant for potential volatility as we digest these economic indicators and the implications they may have on market sentiment.

I am receiving some great questions from beginners. This is helping me develop guides for this group as well as the course. More to come but I’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, I’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, I am closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.