- SPY Options Actionable Levels

- Posts

- Monday September 8 2025 SPY SPX ES Actionable Levels

Monday September 8 2025 SPY SPX ES Actionable Levels

$SPX defends critical level and runs to fresh all time highs in the AM then loses key supports, and falls before defending and running 40+ points. Where is $SPY's next move?

In yesterday’s letter, we wrote:

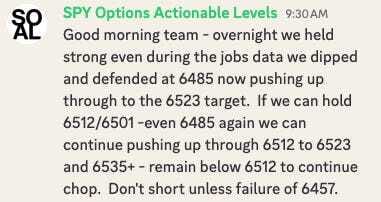

For tomorrow, we’re closely watching the key SPX levels of 6457, 6470, 6485, and 6501. If we hold above 6501, that’s a bullish sign, but we’re still mainly looking for long entries on dips and defenses at 6485, 6470, or even a direct defense at 6457. From there, we can target an upside breakout through 6512, then 6523 and 6535, pushing us deeper into all-time-high territory.

If we lose 6457, however, we want to be short for the move to 6445.”

This is what happened. We experienced a bit of both bullish and bearish action. Initially, there was strong defense at 6485, which propelled us to fresh all-time highs at 6532, just shy of the 6535 target. However, we then encountered weakness and lost key supports at 6470 and 6457, prompting a drop to a low of 6443.98, right at the 6445 support level. Fortunately, we were able to defend that level, reclaim 6457 and 6470, run over 40 points higher and ultimately closed just below the 6485 resistance. $SPY ( ▲ 0.71% ) $SPX ( ▲ 0.78% ) $ES_F ( 0.0% )

See how well the levels work?

Missed the Market’s Big Moves?

The market moves fast - we make sure you don’t miss a thing.

Elite Trade Club delivers clear, no-fluff market intel straight to your inbox every morning.

From stocks to big-picture trends, we cover what actually matters.

Join 100,000+ readers who start their day with the edge.

Now, after a major move that tested and dipped below key supports only to reclaim them - where do we go from here? Where is next must hold level and what upside targets are in play if we do?

More in the trade plan below.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

This trading session exemplified the importance of our levels. Despite the initial bullish momentum, the failure to hold key support levels led to a quick reversal. Always stay vigilant on both sides! Always trust the levels.

Now we are sitting in AH right on the key 6481 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Trading Plan

Today was a monster day with an 88-point range on heavy volume, showcasing the market's volatility.

For Monday, we anticipate a lighter day in terms of scheduled events and reports. However, keep an eye on Wednesday and Thursday for the PPI and CPI releases, as these will be critical data points that could drive the market in the coming week.

We are receiving some great questions from beginners. This is helping us develop guides for this group as well as the course. More to come but we’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, we’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For Monday, we’re closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.