- SPY Options Actionable Levels

- Posts

- Monday November 24 2025 SPY SPX ES Actionable Levels

Monday November 24 2025 SPY SPX ES Actionable Levels

$SPX defends key supports to reclaim higher resistances. Can $SPY repair the damage done?

In yesterday's letter, we wrote:

For tomorrow, we’re closely watching the key SPX levels of 6485, 6516, 6545, and 6596. Now that major supports have been lost, our bias remains bearish until we see clean reclaims of key levels. We will only look to buy (cautiously) on a sustained reclaim of 6545—and we’re not really that comfortable stepping in long until 6596 is taken back. A decisive break above 6596 would then open the door to a push through 6617 and 6638, and potentially much higher as the market attempts to repair the damage done.

If we fail to recapture these higher supports or see rallies stall at 6545 or 6596, we’ll be short on any bounce. Initial downside targets lie at 6516”

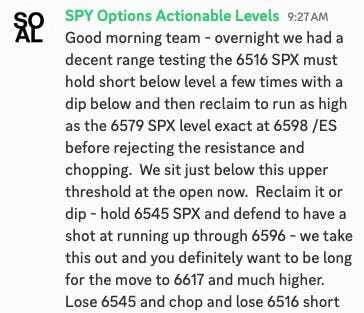

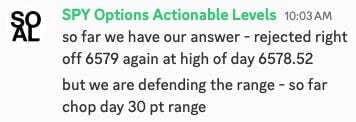

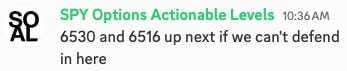

This is what happened. Overnight, SPX tested the critical 6516 support multiple times but managed to defend it. The market then rallied, reaching as high as 6579 SPX (exactly) before facing rejection. During the regular session, we couldn’t reclaim that 6579 level, which led to a drop below 6545, hitting a low of 6521 near the 6516 target before bouncing back strongly and taking out all resistance targets above before dipping and holding 6596 into the close. $SPY ( ▲ 0.72% ) $SPX ( ▼ 0.59% ) $ES_F ( 0.0% )

See how well the levels work?

$57 Billion in NVDA Revenue, 62% YoY Growth. And stocks still fell… What now?

Nvidia just posted a record-breaking quarter… yet the markets dropped. Why?

Experts say that even the top AI earnings couldn’t calm the fear of a potential bubble.

After soaring at the open, the S&P reversed sharply, wiping out over $2T of value in hours.

The “Great Bitcoin Crash of 2025” only wiped out ~$1T by comparison.

Wall Street’s finally asking: What if AI isn’t enough?

So, where can investors diversify when public markets stop making sense?

Now, for members-only → blue-chip art.

It’s not just for billionaires to tie the room together. It’s poised to rebound.

With Masterworks, +70k are investing in shares of multimillion dollar artworks featuring legends like Basquiat and Banksy.

And they’re not just buying. They’re selling too. Masterworks has exited 25 investments so far, including two this month, yielding net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers skip the waitlist:

*Past performance is not indicative of future returns. Investing involves risk. Reg A disclosures: masterworks.com/cd

Now that we’ve seen a bounce, the question remains: can we sustain this momentum? Where do we need to hold to avoid further downside, and what levels should we watch for potential rejections?

More in the trade plan below.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

The rejection off 6579 was significant, but the subsequent rally past 6545 and onward to 6660 demonstrates the market’s resilience. We managed to close at 6596, supporting our view that this level is critical moving forward. Always trust the levels.

Now we are sitting in AH right on the key 6612 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

Trading Plan

Today was marked by a robust 150-point range, ultimately resulting in a 1% bounce higher after yesterday’s decline, all on high volume.

Looking ahead to Monday, we have a relatively light day in terms of data or scheduled events. However, we advise keeping an eye out for any weekend news regarding tariffs or foreign policy decisions, as these could impact the market significantly.

We are receiving some great questions from beginners. This is helping us develop guides for this group as well as the course. More to come but we’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, we’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For Monday, we’re closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.