- SPY Options Actionable Levels

- Posts

- Friday November 21 2025 SPY SPX ES Actionable Levels

Friday November 21 2025 SPY SPX ES Actionable Levels

$SPX reclaims major resistance level in the AM and runs through all upside targets before giving it all back & much more to final 6536 downside support - $SPY

In yesterday's letter, we wrote:

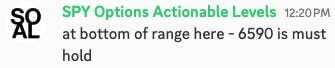

For tomorrow, we’re closely watching the key SPX levels of 6590, 6629, 6651 and 6691. 6691 remains our must-reclaim threshold after today’s tag and rejection, and the resilience of downside supports argues for an eventual move higher. We’ll be biased to the upside, looking to pick longs on a dip & defense at 6629 or on a breakout above 6651/6675. Taking and holding above 6691 opens the door…

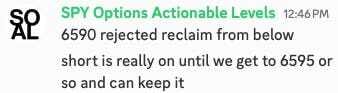

If 6590 gives way, however, we’ll flip to shorts for a drop to 6578, 6566, 6547 and 6536.”

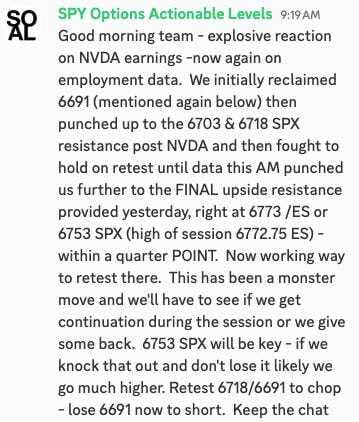

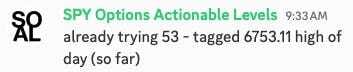

This is what happened. Today was a remarkable day in the markets, characterized by a rare 240-point range without a major catalyst like an FOMC announcement. We opened strong, propelled by a robust overnight rally following NVDA’s stellar earnings, allowing us to reclaim the critical 6691 level. This setup was pivotal for pushing higher, and indeed, we saw a further rally fueled by encouraging employment data, reaching a high of 6772.75 on the ES futures, which is EXACTLY (within 1/4 point) of our final upside resistance target at 6753 SPX.

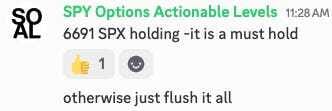

However, the exuberance was short-lived in the regular session. After hitting the high of the day at 6770 SPX, we began to give back gains rapidly. The market fell through ALL crucial support levels, starting with 6691 and then down to 6590, ultimately closing at a low of 6534.05, right at our final downside support target of 6536. It was a classic case of whipsaw action that left traders on edge, underscoring the importance of the levels we provided. $SPY ( ▼ 1.08% ) $SPX ( ▼ 1.05% ) $ES_F ( 0.0% )

See how well the levels work?

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Now, with a significant decline in the rearview mirror, the question becomes: what’s next? Can we reclaim the needed levels to shift sentiment, or are we likely to see further downside?

More in the trade plan below.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

The fact that we called the very top target prior to the open and then nailed the close (6536) and it was all based on key levels 6691 and 6590 reclaiming/rejecting is showing how the market reacts to the key supports/resistances. Always trust the levels.

Now we are sitting in AH right on the key 6530 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

7 Actionable Ways to Achieve a Comfortable Retirement

Your dream retirement isn’t going to fund itself—that’s what your portfolio is for.

When generating income for a comfortable retirement, there are countless options to weigh. Muni bonds, dividends, REITs, Master Limited Partnerships—each comes with risk and oppor-tunity.

The Definitive Guide to Retirement Income from Fisher investments shows you ways you can position your portfolio to help you maintain or improve your lifestyle in retirement.

It also highlights common mistakes, such as tax mistakes, that can make a substantial differ-ence as you plan your well-deserved future.

Trading Plan

Today’s price action was marked by the highest volume we’ve seen since the April Tariff day, a clear indication of heightened market activity and volatility.

As we look ahead to tomorrow, we have options expiration (OPEX) day alongside PMI data, revised consumer sentiment, and inflation expectations, plus at least four FOMC members scheduled to speak. These events will be critical in shaping market direction, so it’s vital to keep a close eye on them for how we react after today’s major see-saw sell.

We are receiving some great questions from beginners. This is helping us develop guides for this group as well as the course. More to come but we’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, we’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, we’re closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.