- SPY Options Actionable Levels

- Posts

- Friday May 9 2025 SPY SPX ES Actionable Levels

Friday May 9 2025 SPY SPX ES Actionable Levels

$SPX defends key breakout level on retest and marches higher. Where is next $SPY target?

In yesterday's letter, we wrote:

For tomorrow, we're closely watching the key SPX levels of 5655, 5605, 5588, and 5570. We remain in a broad-based consolidation zone, and until we can reclaim the 5640–5655 area, it's important to be cautious about leaning too aggressively long.

That said, we could look to long a defense of 5570 or a dip & defense at 5588 or 5605, targeting 5617 and levels higher. If we reclaim 5655, that would be a strong signal to get long, as it likely opens the door for a larger breakout move. Upside targets include 5670, 5691, 5710 - reclaim here to put 5728…on deck.”

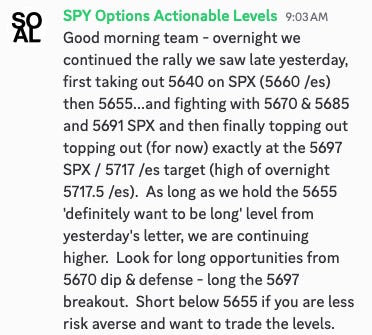

This is what happened. Overnight we had a nice rally that took out the key levels of 5640 and 5655, allowing us to run up to 5670, 5685, and finally 5691 before a dip occurred. After the market opened, we saw the expected dip & defense at 5655, which was critical in propelling the market to a high of 5720, just shy of the 5728 target mentioned yesterday, before we dipped into the close. $SPY ( ▼ 1.02% ) $SPX ( ▼ 1.04% ) $ES_F ( 0.0% )

See how well the levels work?

Feeling Off Lately? Try One Week of Therapy, Free

Life can be overwhelming, but getting support shouldn’t be. This May for Mental Health Awareness Month, BetterHelp is offering one week of therapy completely free, so you can experience what real support feels like—no cost, no pressure.

You’ll be matched with a licensed therapist in as little as 24 hours, and connect on your schedule—by phone, video, or chat. With 35,000+ professionals, there’s someone for you. 94% of BetterHelp users report feeling better after starting therapy, and now you can try it yourself, risk-free.

Now that we've seen a solid rally, where do we go from here? What levels should we be monitoring to ensure we don't lose bullish momentum?

More in the trade plan below.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

The levels played out perfectly today as we initially took out the critical 5640 and 5655 levels, which paved the way for the rally we experienced. Despite closing off the highs, we held the key 5655 level, which is encouraging for the bulls moving forward. It's essential to trust the process, and the defense at 5655 was a key indicator for the next bullish move. Always trust the levels.

Now we are sitting in AH right on the key 5667 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

Trading Plan

Today brought a nice move higher on slightly better volume than yesterday's FOMC.

In terms of tomorrow, we have a long list of FOMC members speaking throughout the day and into the evening, with at least 10 speeches scheduled. This could add additional volatility and market movement, so be sure to stay alert to any shifts in sentiment that might arise from these discussions.

I am receiving some great questions from beginners. This is helping me develop guides for this group as well as the course. More to come but I’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, I’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, we’re closely watching the key SPX levels of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.