- SPY Options Actionable Levels

- Posts

- Friday Feb 2 2024 SPY SPX ES Actionable Levels

Friday Feb 2 2024 SPY SPX ES Actionable Levels

$SPX squeezes hard. What are the must hold levels for $SPY?

Get the best stock ideas

Our AI tool scours the internet every day for the best stock ideas that we share with you each morning in our free, daily email.

We find stock ideas from:

Billion-dollar hedge funds

Professional analysts

Millionaire investors

and more…

We’ve already found stock ideas like:

Carvana ($CVNA) - +822% in 4 months

Myomo ($MYO) - +507% in 3 month

ImmunityBio ($IBRX) - +313% in 1 month

and a ton more…

Subscribe to our free, daily email to start getting the best stock ideas sent to your inbox each morning.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Limited Time - Pre-Order at $99 - 10% off Regular Price

What we’re reading:

In yesterday’s letter, I wrote:

“For tomorrow, I will be watching the key SPX level of 4845.

If we defend this level or quickly reclaim, OR even better not dip below overnight I believe we can reverse here and go higher.

From there we need to reclaim 4861.

Second target is 4871.

3rd target of 4884…

4908 is final 4th bonus target if we decide to squeeze.”

This is what happened. After defending right of 4845 and not retesting overnight we started our move higher.

I went long in ES futures at 4875.5 as called out in the chat.

Overnight we rallied and reclaimed the “must reclaim” 4861 SPX level above. Then we touched target 2 which is 4871.

We fell back below after the open on data and tested the 4851 level before rallying higher.

Reclaiming the levels above plus 3rd target of 4884 and 4908 we ran right through after the close on tech earnings.

See how well the levels work?

We squeezed even harder after hours all the way to reject at 4941 SPX level provided yesterday.

How did my ES long from 4875.5 turn out?

I closed 50% at 4883.25

Another 40% at 4893

And the remaining 10% after hours today at 4960.

Now that we defended the top of “breakout Friday” and squeezed to new all time highs. What are the must hold levels to keep our path higher at play and what are next targets above to prove we are on track?

More in the trade plan below.

The 0DTE $SPY 485 calls ran from a low of $80 to $623 = 679% gain.

What are these, SPX contracts? Talk about a massive move for SPY contracts. I traded these called out in the chat from $90 to $325 at best sale for 261%. This was my second trade after entering 487 calls that I took half off for profit and stopped out on the rest. More in the trade recap below.

Below, we’ll cover the actionable levels, how I played them today and what they mean for the next session.

Levels from the prior letter were great. Once we held the key must hold level from yesterday’s letter and trickled up it was clear the direction. Then when we reclaimed target 2 and 3 we knew we were in store for much higher. Always trust the levels!

Now we are sitting in AH right under the 4936 key resistance level. What does this all mean and where do we go from here? Read below for my trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Trading Plan

Here is a current check of the daily:

This includes all the way back to 6/29 & all overnight action.

Defended the top of the breakout and recovered all of yesterday’s retreat plus more!

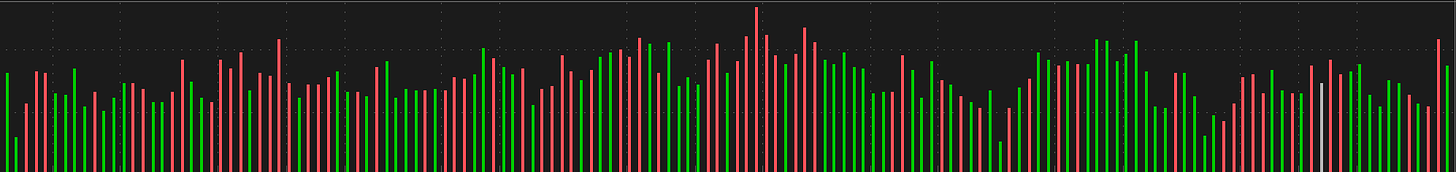

Quick volume check:

Decent volume - not a panic day and healthy buying.

Tomorrow we have some data in the AM, pre and post open. The big one is employment.

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For tomorrow, I will be watching the key SPX level of…

Subscribe to Premium to read the rest.

Become a paying subscriber of Premium to get access to this post and other subscriber-only content.

Already a paying subscriber? Sign In.

A subscription gets you:

- • Actionable SPY SPX Levels provided daily.

- • Trade recap and current outlook and plan for the next session.

- • Live Chat during market hours. Join the community including comments/discussion.

- • Subscriber-only posts and full archive.