- SPY Options Actionable Levels

- Posts

- Free For ALL Repost 1 Monday April 21 2025 SPY SPX ES Actionable Levels

Free For ALL Repost 1 Monday April 21 2025 SPY SPX ES Actionable Levels

$SPX holds key level overnight to rally only to chop during the day with an attempted breakout. Is $SPY about to sell on mounting concerns?

This is a repost of Thursday’s letter for Monday.

In yesterday’s letter, we wrote:

For tomorrow, we're closely watching the key SPX levels of 5228, 5248, and 5297. We had a decent bounce into the close today, but we need to approach any long setups with extreme caution…it's too risky in our view to long a reclaim of 5280 without a dip first—unless we break out cleanly through 5297. That level opens the door to a stronger move higher and would be another spot to consider a long entry.

If that breakout plays out, we can push up through 5315 and 5329…”

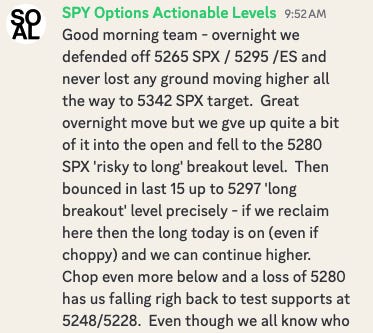

This is what happened. The levels played out tremendously well with a solid overnight defense at 5265, allowing for a rally up to 5342 before we lost 5280 right after the open. Then we saw 5297 stop becoming resistance and becoming support as the breakout occured. The move ran to 5320 and peaked at 5328.31, just shy of the 5329 target we had identified. Then we slid back into the close, where we were able to bounce again at the 5280 support. $SPY ( ▲ 0.72% ) $SPX ( ▲ 0.69% ) $ES_F ( 0.0% )

See how well the levels work?

The gold standard of business news

Morning Brew is transforming the way working professionals consume business news.

They skip the jargon and lengthy stories, and instead serve up the news impacting your life and career with a hint of wit and humor. This way, you’ll actually enjoy reading the news—and the information sticks.

Best part? Morning Brew’s newsletter is completely free. Sign up in just 10 seconds and if you realize that you prefer long, dense, and boring business news—you can always go back to it.

Now that we navigated through today’s trading, where do we stand moving forward? What levels and targets should we keep in mind, and how can we manage risk amidst the current market conditions?

More in the trade plan below.

Below, we’ll cover the actionable levels, how we played them today and what they mean for the next session.

The levels were spot on, the 5265 defense, the 5297 rejection and then breakout long to 5329 target! Always trust the levels.

Now we are sitting in AH right on the key 5287 support level. What does this mean and where do we go from here? Read below for our trade plan which includes actionable support & resistance levels, outlook for the next session and today’s trade recap.

Learn the system to make 1-3 low risk, high reward trades per day using SPY/SPX options.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up for a paid subscription.

Don’t miss the Topic Directory - Getting lots of questions that are answered in here.

There seems to be some confusion as to the premium subscription and the discord chat. If you are premium and you do not have access to the “Premium Members Only” channels including “members-only” please authenticate yourself in the “bot-request-premium” chat. Or send me a DM in the discord!

Also - if you missed it - join our chat during market hours for premium subscribers. We are now leveraging discord for this. Link is at the very bottom of premium content: Trading Plan section below.

Order Now - New lessons out!

Trading Plan

Today was a chopfest in a tighter range on lower volume. As we head into the long weekend, be on the lookout for news regarding tariffs and deals that could impact the market.

On Monday, we have at least one FOMC member speaking during the day, which could bring additional volatility and trading opportunities. Stay alert and plan your trades carefully!

I am receiving some great questions from beginners. This is helping me develop guides for this group as well as the course. More to come but I’ve created a separate channel in the discord just so you can not be shy about bringing those questions to the group. No question is dumb, we grow stronger together!

In fact, I’ve created this single resource as a guide. It is a living document and we will continue updating it. You must be logged into the site to read it:

https://letter.spyoptionsactionablelevels.com/p/strategy-guide-the-basics

As readers know trading after a massive move in either direction is risky.

Trying to predict when trend will break is a fool’s game because the trend can be stronger than you ever realize.

Going with the trend is hard because it has already run so far (or dropped) and move may be close to over.

All you can do is pick your entries carefully and with proper position sizing. Trading out 1-3 DTE or further also helps soften the blow.

Yes it will decrease the amount of profit but will greatly help keep you in a trade long enough to see return.

For Monday, we're closely watching the key SPX levels of 5281, 5265, and 5317. If we fail at 5265, we want to short—this should bring up 5246 and 5228 in a hurry, and if those levels don't hold, 5208 and 5189 are next. That area could produce a bounce and present a long opportunity, but we would wait for a clear reclaim of a key level above before jumping in. If buyers can’t hold that zone, then 5162, 5144, 5116, and even 5087 are likely on deck.

If, however, we get an opportunity to long on a direct defense of 5265 or a dip and defense at 5281, then we can make a run to 5301 and 5317 breakout. Holding there on a retest sets us up to target 5338, 5366, and 5393. A clean break above that opens the door for a squeeze higher to 5418, 5446, 5463, and even 5479.

Good news is that we don’t have to predict, we just have to have the levels that prepare us for the session and react appropriately no matter what happens. Reacting, not predicting, is critical to being successful.

The volume, overnight session, and open will provide the clues on where we head in the AM.

We will be trading the levels (supports & resistances posted below) and not worried about predicting in advance. Just trading the price action as we see it. The volume, # of advancing vs declining and $VIX will help guide where we are headed. We do not have to be first in or last out, we are happy catching part of a move and ensuring we grow profits consistently.

If you are enjoying this letter, consider sharing with a friend! We even have a referral program where you can earn free subscription time for referring others that sign up.

If we can help in any way, please tweet or DM us and we’ll get back to you. I have found joy in sharing what knowledge I have on the subject & I only charge what makes it worth putting this together daily.

If you have found success, please tweet us! We would love to hear how it is working for you.

Discord Link for Premium Subscribers: https://discord.gg/MNtvz8aZeM

Trade Recap

We traded the 5297 breakout per plan which ran to 5320 and then later 5328-just shy of the 5329 target!

Hindsight is 20/20 and you cannot dwell on what you would have done differently or what you feel were mistakes. No one is going to catch the entire move, or do everything perfectly. The goal is to learn from it and continue to do better each and every day.

1-3 trades per day is all you need. It’s about quality over quantity to be consistent. Trust the levels, use proper risk management and everything will be in your favor. Do more than that, you are asking to lose big.

Did I catch every move? Absolutely not, that’s not what I do.

The goal is to make consistent gains instead of swinging for the fences. Base hits, not home runs. Stay in the game as there are always more opportunities tomorrow.

You can use an offset of 31 points for ES-Jun Contract (add 31 points to SPX for ES level)

Key Supports (SPX)

5287

5281

5275

5265

5255

5246

5237

5228

5218

5217

5208

5198

5189

5179

5174

5168

5162

5155

5150

5144

5139

5133

5123

5116

5109

5103

5096

5087

Key Supports (SPY)

527.07

526.47

525.87

524.87

523.87

522.97

522.07

521.17

520.17

520.07

519.17

518.17

517.27

516.27

515.77

515.17

514.57

513.87

513.37

512.77

512.27

511.67

510.67

509.97

509.27

508.67

507.97

507.07

Key Resistances (SPX)

5293

5301

5309

5317

5325

5332

5338

5344

5350

5357

5366

5375

5381

5387

5393

5399

5409

5418

5428

5437

5446

5455

5463

5471

5479

Key Resistances (SPY)

527.67

528.47

529.27

530.07

530.87

531.57

532.17

532.77

533.37

534.07

534.97

535.87

536.47

537.07

537.67

538.27

539.27

540.17

541.17

542.07

542.97

543.87

544.67

545.47

546.27

Key Notes

This is not financial advice. This helps keep me honest and is a place for my notes. It is for educational & entertainment purposes for all who choose to subscribe. Not all investments are suitable for all investors.